South Africans are moving away from traditional banking halls and physical cards to banking on smart devices and cellphones.

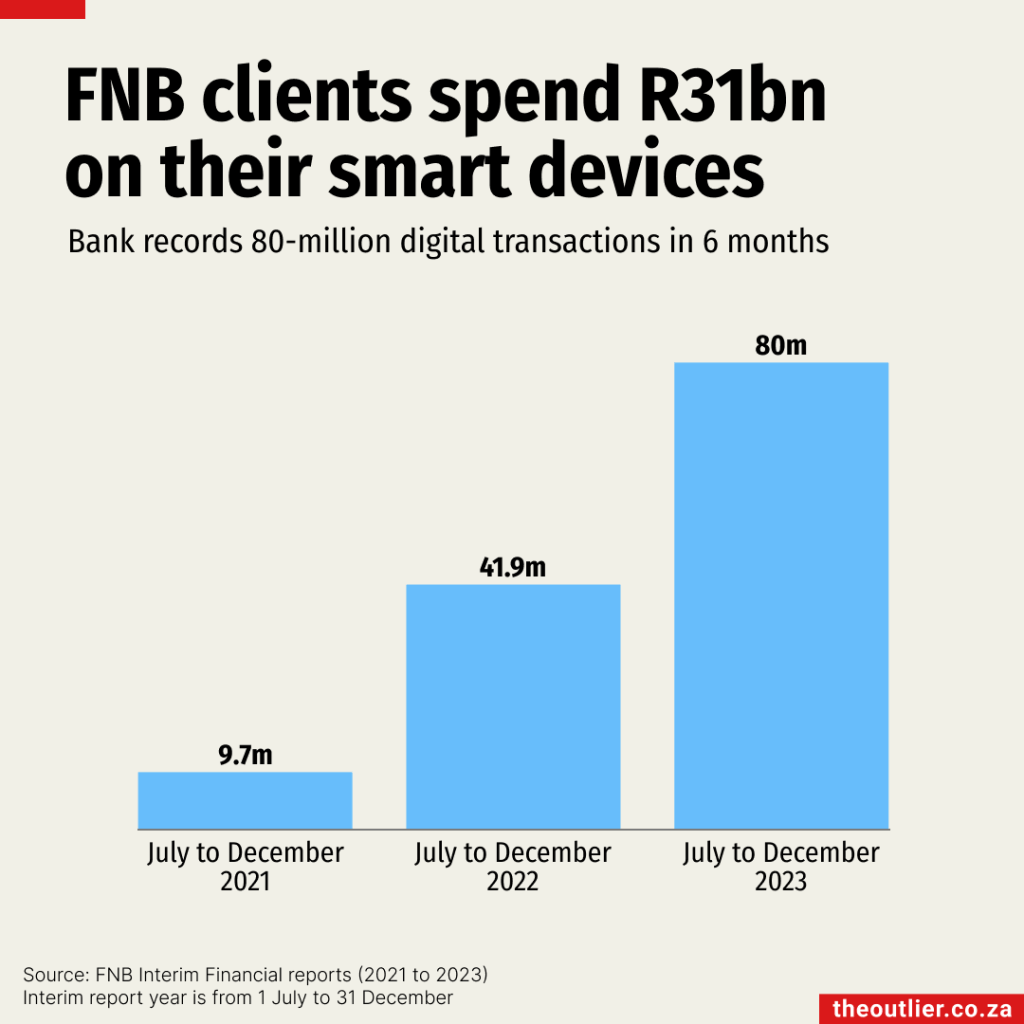

Standard Bank clients spent R9.3-billion using digital wallets in the past year. It sounds incredible, until you compare it with FNB clients, who spent R31-billion using their smart devices in the six months between July and December 2023.

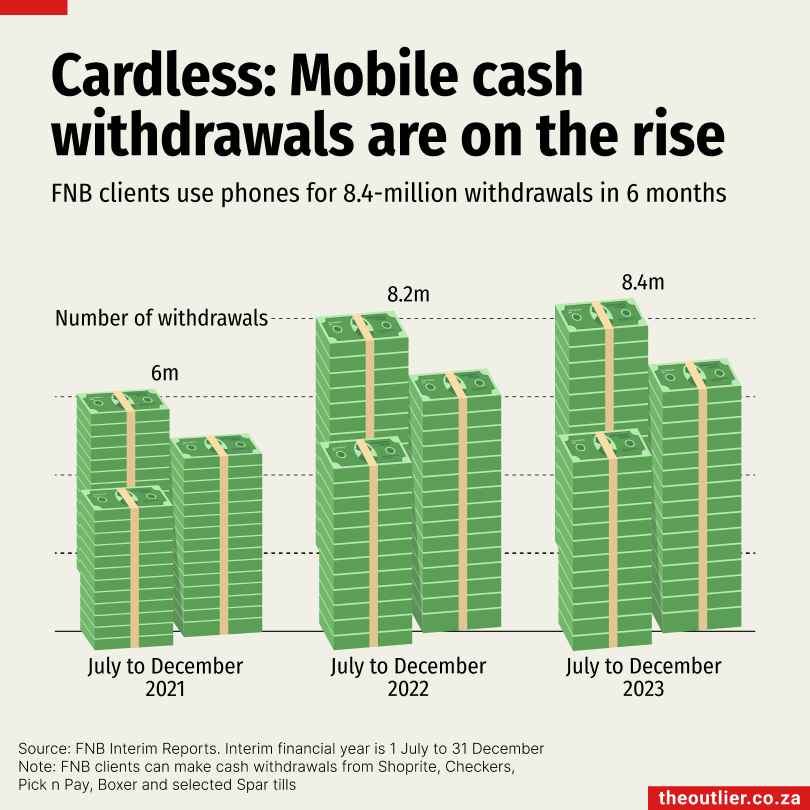

South Africans’ preference for digital is also evident in the rising number of withdrawals made on smart devices instead of with a bank card. Data from FNB shows digital withdrawals increased to 8.4-million in six months last year from 6-million over the same period in 2021.

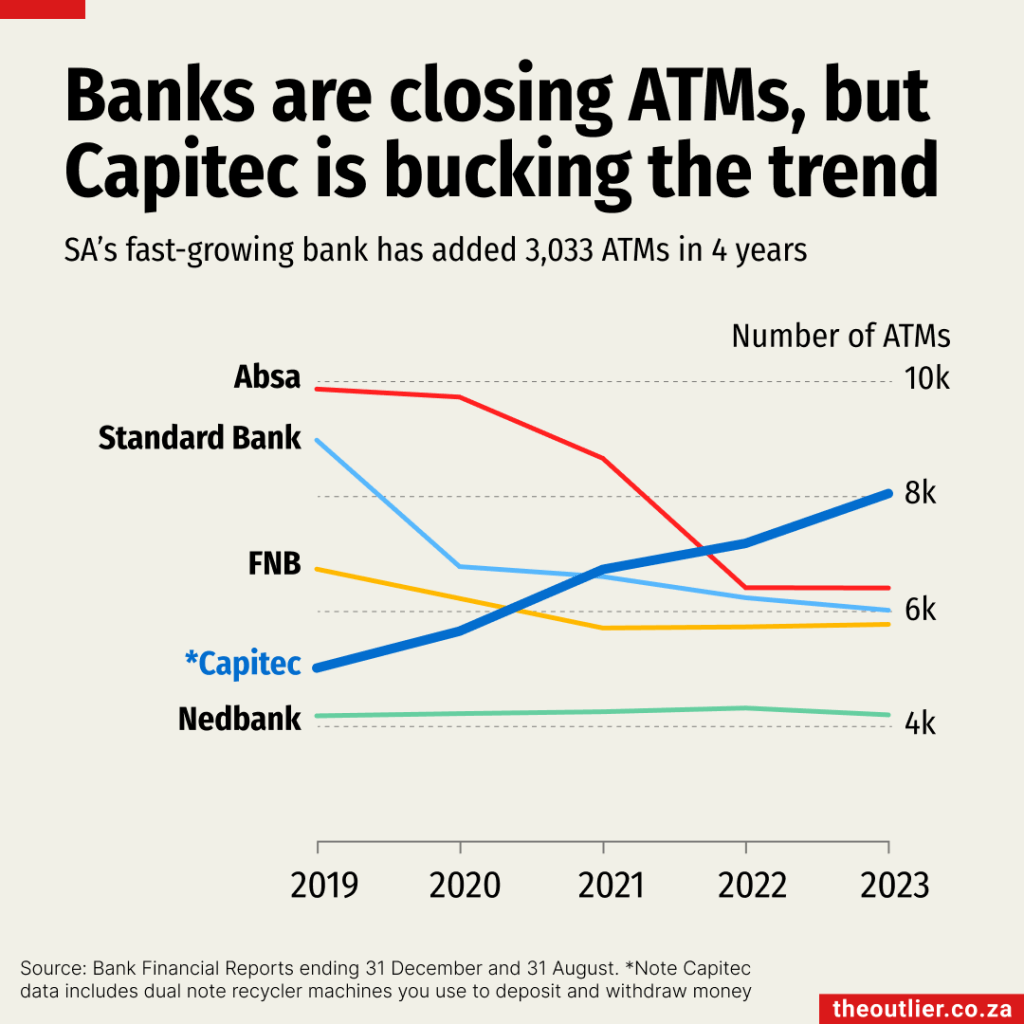

The increase in mobile banking has also seen most of South Africa’s major banks closing ATMs, with a notable decline in machines in the past four years. Capitec, however, has chosen to increase its footprint and installed more than 3,000 ATMs between 2019 and 2023. It now has just over 8,000 teller machines across the country, the most of all the banks.

Notebook

- This story was first published in The Outlier newsletter. Sign up