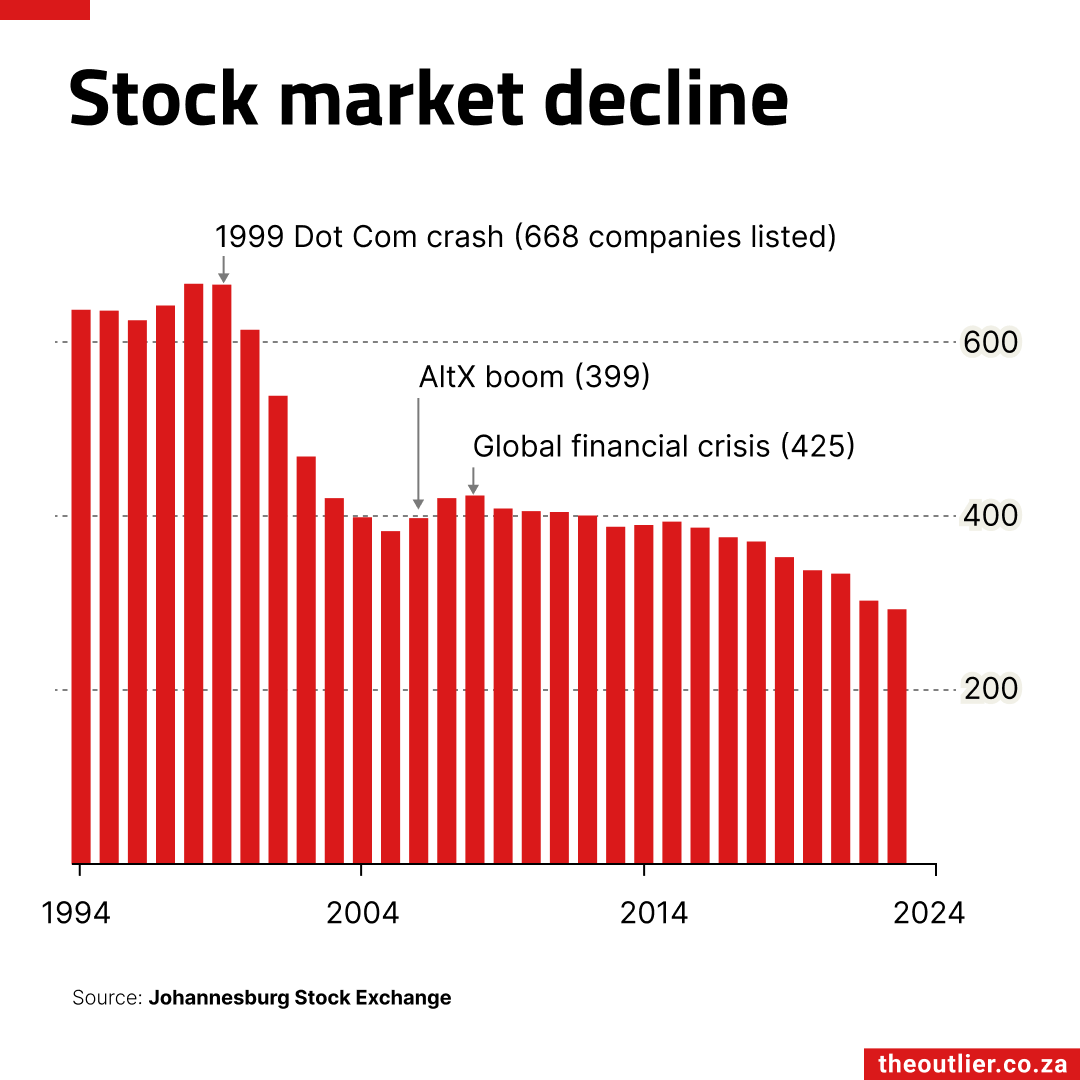

The number of companies listed on the JSE, South Africa’s securities exchange, has reached a 30-year low.

Listings peaked at 669 listings in 1998, but the dot-com crash led to 128 companies delisting within 2 years. There was a brief resurgence between 2003 and 2008 with the introduction of AltX, which targets small- and medium-sized enterprises. This was cut short by the global financial crisis.

Delisting is a global phenomenon and not isolated to South Africa, says Sam Mokorosi, JSE’s head of origination and deals.

Companies often delist due to mergers, acquisitions or relocating abroad, but the JSE has struggled to attract enough new listings to offset these losses.

Mokorosi said high IPO activity is typically driven by GDP growth and supportive sector policies.

To boost listings, the JSE is reducing listing bureaucracy, introducing dual-class shares, revising auditor accreditation and allowing secondary listings for companies primarily lis…